When it comes to safeguarding your economic future as well as structure wide range, one strategy that usually goes ignored is actually the Precious Metals Individual Retirement Account, or Precious Metals IRA While typical pension like 401( k) s as well as IRAs are actually well-known, the Precious Metals IRA offers an one-of-a-kind and potentially lucrative opportunity for transforming your financial investment profile and securing your wealth against economical volatility.

In this particular short article, our team’ll discover what a Precious Metals IRA is actually, why it’s an useful add-on to your retirement preparing, how to prepare one up, as well as the potential benefits it may offer your monetary future. Allow’s dive in.

Understanding the Precious Metals IRA

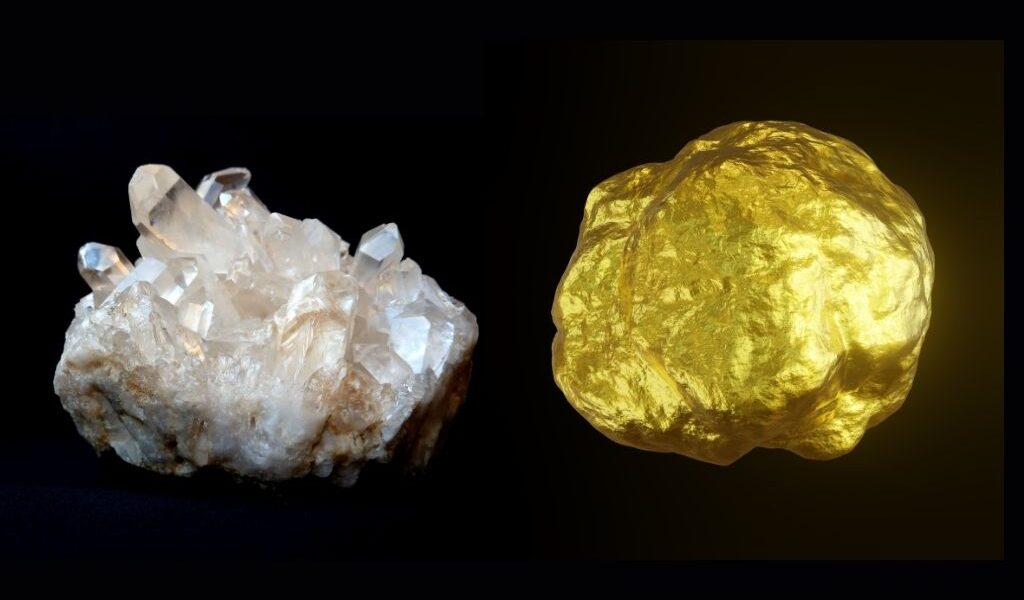

A Precious Metals IRA is a specific form of Individual Retirement Account that permits capitalists to secure bodily rare-earth elements like gold, silver, platinum, as well as palladium within their pension. This varies coming from a regular IRA, which normally keeps a mixture of assets, connections, and various other economic possessions.

Real estate investors can easily open up a Precious Metals IRA along with a qualified manager or trustee that provides services for taking care of rare-earth elements investments. These custodians are responsible for making certain observance with IRS rules regulating gold and silvers held within pension. It’s important to decide on a professional protector with a solid record to make certain the safety and security as well as legality of your expenditures.

Why Choose a Precious Metals IRA?

- Variation: Diversifying your investment collection is a vital technique to handle threat as well as maximize returns. Gold and silvers, with their historically low relationship to conventional possessions like equities and connects, offer a superb ways of diversity. When various other investments could trip up during financial slumps, precious metals usually execute effectively, working as a bush against rising cost of living as well as money decrease.

- Riches Preservation: Precious steels have been a retail store valuable for centuries. Gold, as an example, has maintained its worth eventually, making it an exceptional option for keeping wealth. By including gold and silvers in your retirement account, you can make certain that a section of your discounts continues to be resistant also in unstable economical opportunities.

- Tax Benefits: A Precious Metals IRA gives possible tax perks. Payments to a Precious Metals IRA can be tax-deductible, depending on your profit and also the form of IRA you select. Also, the development of your expenditures within the profile may be actually tax-deferred or even tax-free, depending on the circumstances of your withdrawals in retirement life.

- Profile Protection: Precious steels are actually known for their capacity to serve as a secure against economic crises, geopolitical instability, and currency devaluation. Holding physical resources in a Precious Metals IRA indicates that you are actually much less susceptible to the dryness of the securities market or even the anxieties of the international economic climate.

- Capital Gains: When you invest in precious metals, any possible capital increases you earn may be actually taxed at a reduced price matched up to other forms of investments. This can easily cause more of your incomes remaining in your wallet.

Establishing a Precious Metals IRA

- Select a Custodian: The first step in establishing a Precious Metals IRA is actually to decide on a trustworthy manager or even trustee. You can look into and match up custodians to find one that lines up along with your expenditure goals and market values.

- Fund the Account: Once you’ve chosen a custodian, you’ll need to finance your Precious Metals IRA. You can possibly do this by rolling over funds from an existing pension or even making yearly payments, which are subject to IRS limits. Your manager can lead you through the financing process.

- Acquisition Precious Metals: After your profile is actually funded, you can easily begin obtaining gold and silvers. Your manager will aid you in helping make these acquisitions. It is actually vital to remember that the IRS possesses strict guidelines pertaining to the kinds of gold and silvers that can be held in a Precious Metals IRA. Generally, simply specific types of gold, silver, platinum, and also palladium are eligible.

- Storing as well as Security: Precious metallics should be actually stashed in an IRS-approved depository. These establishments are furnished with sophisticated security actions to protect your properties. You won’t be actually permitted to hold the gold and silvers in your property, as this will breach IRS rules.

The Benefits of Precious Metals IRA.

- Defense Against Economic Uncertainty: Precious metallics have a strong performance history of carrying out properly when traditional properties are actually under the gun. Economic declines, market collisions, and inflationary durations typically see the market value of gold and silvers increase, functioning as a safe house for capitalists.

- Wide range Preservation: As pointed out previously, gold and silvers are renowned for maintaining wealth as time go on. Gold, specifically, has sustained its own market value for centuries. By integrating precious metals right into your retirement account, you’re essentially guaranteeing that a part of your savings stays sturdy and also resisting to economical volatility.

- Diversity: Diversifying your assets collection is a fundamental strategy for danger administration. Gold and silvers, along with their in the past reduced connection to traditional possessions, give a successful methods of variation. They can aid balance your profile and also minimize danger during rough market ailments.

- Income Tax Advantages: Depending on your revenue and the kind of Precious Metals IRA you opt for, you might profit from tax obligation rebates on contributions as well as tax-deferred or even tax-free development within the profile. These income tax advantages can significantly affect your total wealth buildup.

- Capital Gains Opportunities: Precious metals can offer opportunities for capital increases, which are actually often taxed at a lesser fee than other types of expenditure income. This can result in more of your profits continuing to be along with you rather than going to the income tax authorities.

Risks and also Considerations

While a Precious Metals IRA supplies lots of conveniences, it’s essential to understand possible risks and also points to consider:

- Market Volatility: The market value of rare-earth elements may be subject to market variations. It is actually significant to honor that they are not completely safe. Having said that, their historic efficiency recommends that they could be a beneficial add-on to a varied portfolio.

- Storing Costs: Storing gold and silvers in an IRS-approved vault sustains expenses. These charges can easily differ relying on the depository and the amount of metals you support. It’s critical to factor these expenses into your assets method.

- Liquidity: Selling gold and silvers from your IRA may be a bit even more complicated than selling shares or even connections. You might need to have to partner with your manager to promote the process, and it might spend some time to access your funds.

- IRS Regulations: To sustain the tax obligation advantages of a Precious Metals IRA, it’s crucial to follow IRS standards pertaining to qualified metals and storage space. Falling short to perform so might cause fines and also income taxes.

Conclusion

A Precious Metals IRA is a powerful device for optimizing your riches and also safeguarding your financial future. Through transforming your retirement profile with metals, you may shield your savings versus economical volatility, maintain wide range in time, take pleasure in potential tax benefits, and make the most of reduced tax obligation fees on financing increases. Nevertheless, like any expenditure technique, it’s essential to know the threats and follow IRS policies to completely receive the incentives of a Precious Metals IRA.

To maximize this option, start by picking a credible custodian, financing your account, as well as opting for the appropriate mix of metals to match your expenditure targets. With cautious preparing as well as direction coming from professionals in the business, you can easily create a strong retired life tactic that improves your financial safety and ability for wealth build-up over time.