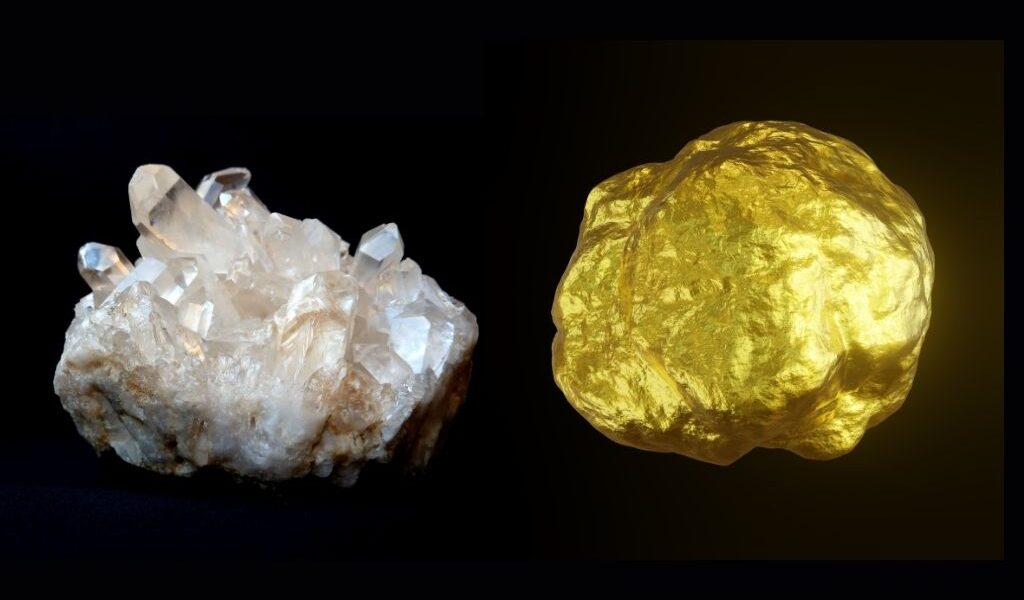

Recognizing American Hartford Gold

American Hartford Gold is a rare-earth elements firm that focuses on helping individuals add physical gold and silver to their financial investment profiles. Based upon american hartford gold review concepts of openness, security, and consumer contentment, the company aims to give investors a risk-free chance to broaden their possessions and safeguard against the rising cost of living and market volatility.

What Establishes American Hartford Gold Apart?

Customer-Centric Technique: American Hartford Gold’s values are centered on client contentment. The firm prioritizes structure and long-lasting connections with clients by supplying personalized services and alternatives to meet private investment purposes.

Educational Resources: American Hartford Gold understands that notified capitalists make better choices. Because of that, they offer abundant educational resources containing short articles, guides, and professional understandings to equip consumers with the expertise needed to navigate the complicated globe of precious metals spending with self-confidence.

Individual Retirement Account Providers: Identifying the importance of retired life planning, American Hartford Gold provides specialized solutions for consumers aiming to include rare-earth elements into their individual retirement account accounts. By promoting the procedure and ensuring conformity with Internal Revenue Service laws, the business makes it possible for plutocrats to protect their retired life cost financial savings with considerable properties.

The Investment Refine

Purchasing rare-earth elements through American Hartford Gold is an uncomplicated process developed to decrease complexity and make the very best use of benefits for clients:

Consultation: The journey begins with an evaluation, where customers review their financial objectives, threat resistance, and investment choices with a specialized account representative.

Education, learning, and knowing: With in-depth proficiency concerning precious metals and their function in a flexible financial investment method, clients can make informed choices that align with their purposes.

Alternative: Based upon examination and academic sources, consumers pick the kind and amount of rare-earth elements they desire to obtain, such as gold, silver, platinum, or palladium.

Procurement and Storage space: Once the alternatives are made, American Hartford Gold promotes the acquisition and arranges for secured storage space through trusted third-party safes, guaranteeing the security and protection of consumers’ properties.

Pros and Cons

Pros:

Diverse Item Array: American Hartford Gold supplies numerous rare-earth element items, consisting of coins and bars, making it possible for capitalists to customize their portfolios according to their preferences and budgets.

Individual retirement account Experience: With specialized expertise and experience in individual retirement account rare-earth elements investing, American Hartford Gold improves the procedure for customers aiming to integrate silver and gold into their retirement accounts.

Educational Resources: American Hartford Gold’s rich educational products motivate clients to gain the knowledge needed to make enlightened economic investment selections and confidently surf the details of the rare-earth elements market.

Cons:

Limited Physical Places: While American Hartford Gold generally runs online and over the phone, some capitalists might select the alternative of checking out physical areas for in-person evaluations and purchases.

Understanding the Dangers

1. Volatility

Despite its reliability as a safe-house property, gold can be unpredictable in the short term. The rate of gold can experience considerable adjustments due to factors such as adjustments in capitalist views, geopolitical stress and anxiety, and economic information launches. As a result, capitalists have to be ready for rate volatility when acquiring gold.

2. No Income Generation

Unlike dividend-paying supplies or interest-bearing bonds, gold does not generate earnings. It is mostly a store of value rather than an income resource. Consequently, plutocrats who focus on normal earnings may discover gold much less enticing as a financial investment option.

3. Storage Space Area and Insurance Rates

Physical gold requires appropriate storage space and an insurance policy to shield against burglary, damage, or loss. Depending on the quantity of gold possessed, storage and insurance plan prices can be collected with time. In addition, saving gold in your home presents security risks, while maintaining it in a safe facility could incur added charges.

4. Regulatory and Counterparty Dangers

Purchasing gold via businesses like American Hartford Gold includes controlling and counterparty threats. While reputable organizations comply with governing demands, regulative adjustments constantly threaten the gold market. Furthermore, investors need to study and consider the integrity and dependability of the firm they choose to collaborate with.

Transparency and Dependability

When evaluating any investment opportunity, openness and integrity are non-negotiable. American Hartford Gold prides itself on these principles, intending to cultivate dependability and self-esteem among its customers. The company provides clear and succinct information regarding its services or products, assuring that investors are informed before making any choices.

One of American Hartford Gold’s significant elements is its dedication to customer education and learning. With interesting resources and committed help, the firm furnishes sponsors to understand the details of rare-earth element financial investment and make informed choices aligned with their economic goals.

Item Offerings

American Hartford Gold offers a variety of products to suit varying capitalist options and goals. Whether you’re aiming to acquire physical silver and gold for treasure conservation or considering a rare-earth elements IRA for retired life preparation, the company has alternatives to match your demands.

A few of the vital products used by American Hartford Gold include:

Gold Coins: American Hartford Gold supplies an option of gold coins from identified mints, utilizing investment-grade and collectible alternatives.

Silver Coins: For sponsors considering silver, the firm offers a variety of silver coins, including notable selections such as American Silver Eagles and Canadian Maple Leafs.

Silver And Gold Bars: Capitalists seeking larger amounts of rare-earth elements may choose silver and gold bars, which utilize purity and liquidity.

Rare-earth Elements IRAs: American Hartford Gold assists in developing self-directed precious metals Individual retirement accounts, enabling financiers to include silver and gold in their retirement profiles.

Conclusion

In a globe determined by financial unpredictability and market volatility, attracting rare-earth elements as a safe house possession has never been more effective. American Hartford Gold provides sponsors with a relied-on companion in their journey to broaden their accounts and protect their riches versus inflation and geopolitical dangers. With a customer-centric technique, dedication to openness, emphasis on education learning, and knowing, the firm stands out as a sign of stability and stability in the rare-earth elements market. Whether you’re a knowledgeable capitalist or looking at rare-earth elements for the first time, American Hartford Gold offers the know-how and sources called for to surf the intricacies of the market and make enlightened investment choices for a safe and protected monetary future.