Protecting Your Shining Properties: 2024 FAQs Concerning Precious Metals IRA Custodians

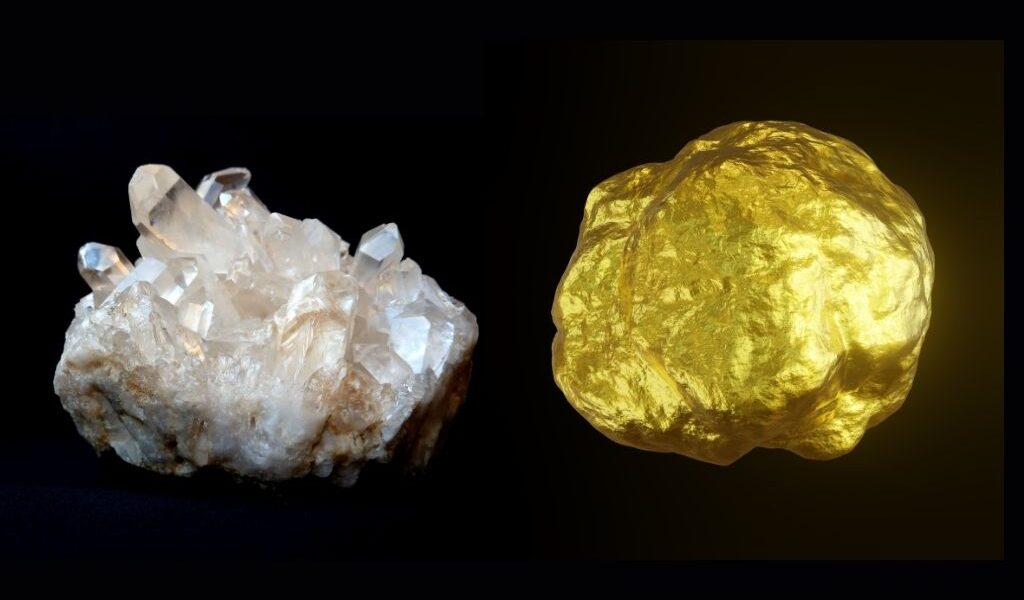

As unpredictability ripples via the financial landscape, investors are increasingly looking for places for their retired life savings. One strategy gaining grip is investing in physical rare-earth elements like gold, silver, platinum, and palladium with a Valuable Metals IRA (PMI). However before you embark on this golden journey, the inquiry of safekeeping your precious assets arises. Get in the PMI custodian, the trusted vault-keeper of your glittering retirement future. Browsing the intricacies of selecting the ideal one in 2024 can seem challenging, yet fret not! This thorough guide illuminates your course, addressing your most important Frequently asked questions concerning Valuable Metals IRA custodians.

Q: What is a Valuable Metals IRA custodian?

Consider a PMI custodian as the gatekeeper of your physical rare-earth elements held within your PMI. They give safe storage space in insured safes, assist in trading of your steels within the individual retirement account, and make certain conformity with internal revenue service regulations. Think of them as a Fort Knox for your retirement, minus the laser beams and containers.

Q: Why choose a separate custodian for my PMI?

Standard individual retirement account custodians typically deal with paper possessions like supplies and bonds. PMI custodians specialize in dealing with the physical logistics and policies bordering precious metals IRA faq. Their proficiency and safe infrastructure guarantee maximum protection and simplicity of administration for your golden savings.

Q: What are the essential factors to consider when picking a PMI custodian?

Several critical aspects deserve your focus:

Reputation and track record: Choose a custodian with a long-standing history and favorable online reputation within the sector. Try to find independent testimonials and industry scores to collect understandings.

Protection and insurance: The custodian’s vault must be fully insured versus burglary, fire, and other potential dangers. Search for accreditations like ISO 9001 and ISO 27001, showing dedication to quality and safety and security monitoring.

Costs and solutions: Compare yearly storage charges, purchase charges for dealing metals, and any kind of extra service charges. Keep in mind, the most affordable alternative isn’t always the best– prioritize safety and security and dependability.

Location and accessibility: Take into consideration the place of the vault in relation to your demands. Some custodians use geographically diverse vault alternatives, while others have actually streamlined places.

Customer service: Responsive and educated customer service is crucial. Ensure the custodian supplies clear communication and easy access to info concerning your holdings.

Q: What are some 2024 details considerations?

The developing PMI landscape in 2024 causes extra variables to consider:

Regulative modifications: Stay notified concerning potential changes in IRS laws impacting PMIs. Select a custodian knowledgeable about and proactively adjusting to these updates.

Technological innovations: Some custodians offer on the internet account administration tools and advanced security features. Take into consideration these alternatives if electronic access and openness are concerns for you.

Diversification alternatives: Some custodians allow investments in a more comprehensive range of precious metals beyond simply silver and gold. Study your alternatives if expanding your PMI holdings is very important to you.

Q: Can I change PMI custodians if I’m not satisfied?

Yes, yet it’s not a simple process. Consult your current custodian and the internal revenue service for particular treatments and possible tax effects. Guarantee you comprehend the expenses and logistics included prior to initiating a transfer.

Q: Beyond fees, what are some possible red flags to watch out for?

Beware of aggressive advertising techniques, unrealistic guarantees of high returns, or concealed fees. Conduct thorough research study before devoting to any custodian. Bear in mind, if it seems too good to be true, it most likely is.

Q: Just how can I ensure my PMI holdings are risk-free and safeguard?

Diversify your custodians: Think about spreading your holdings throughout numerous respectable custodians for added security and potential geographical advantages.

Remain notified: Screen your account declarations and purchase history routinely. Ask questions and clear up any inconsistencies quickly.

Testimonial your custodian occasionally: As your requirements and the PMI landscape develop, periodically review your custodian’s efficiency and fees. Don’t hesitate to consider options if essential.

Digging Deeper: Your Overview to Particular Custodian Types

While most PMI custodians supply similar core solutions, some focus on satisfying particular capitalist demands. Let’s discover a few kinds:

- Huge, recognized custodians: These firms flaunt substantial experience and solid security infrastructures, typically holding billions in precious metals for customers. Ideal for those looking for security and industry-leading safety protocols.

- Independent, store custodians: These smaller sized companies provide even more tailored service and possibly reduced charges. Their flexibility might interest investors looking for customized investment choices or specific niche precious metals offerings.

- Digital custodians: Accepting the technical wave, these firms provide online account administration and sophisticated protection functions like multi-factor verification. Perfect for tech-savvy financiers who prioritize accessibility and transparency.

Past the Safe: Understanding Extra Providers

Some custodians surpass fundamental storage space and deal assistance, offering:

IRA rollover aid: Streamline the procedure of transferring funds from existing Individual retirement accounts into your PMI.

Metal option assistance: Gain access to expert recommendations on picking the right rare-earth elements for your investment strategy.

Educational resources: Discover PMIs, market trends, and financial investment techniques with webinars, write-ups, and various other resources.

Estate Planning with a Touch of Gold:

Incorporating your PMI holdings right into your estate plan is critical. Talk about these factors with your monetary advisor and lawyer:

- Recipient designations: Clearly name recipients to make sure smooth transfer of your PMI upon your passing.

- Tax obligation effects: Recognize the possible tax obligation consequences for your beneficiaries acquiring a PMI.

- Custodian sequence plans: Guarantee your picked custodian has a clear process for taking care of account transitions in the event of fatality or inability.

Shining a Light on Your Golden Future:

Choosing the best PMI custodian is a crucial step towards protecting your retirement protection. By taking into consideration the factors outlined above and prioritizing your specific requirements, you can guarantee your rare-earth elements investments radiate brightly throughout your golden years. Bear in mind, patience, thorough study, and a healthy dose of skepticism are your allies in navigating the gleaming globe of PMIs.

This detailed guide supplies a roadmap for 2024, yet particular circumstances and concerns might call for specialist economic recommendations. Consult your consultant to assess your specific situations and customize your PMI journey to your distinct golden goals. The PMI landscape is vibrant and developing. Keep informed about potential regulatory changes, technology improvements, and brand-new investment choices associated with precious metals. Keep in mind, continuous learning and notified decision-making are vital to safeguarding an intense and prosperous future with your PMI.